Markets show some bullishness near highs! 📉📈Here’s a quick breakdown of today’s price action, key levels, and a smart options strategy to navigate this range-bound market

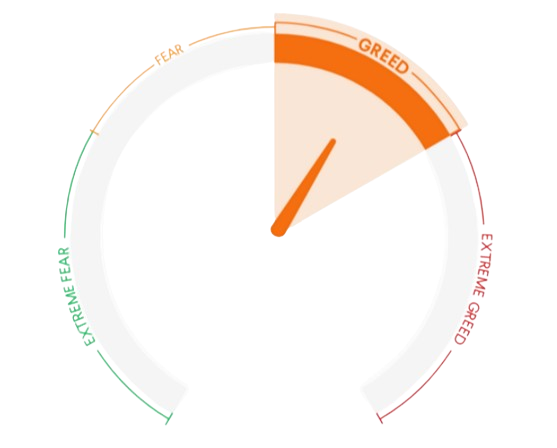

Market Mood Index

63.05

MMI is in the Greed Zone .it suggest that investors are acting greedy in market.

Key Global Indices

As of 06:52 AM, July 9th

| Index/Asset | Country | Value | Change | Change (%) | |

|---|---|---|---|---|---|

| ↓ | GIFTNIFTY | India | 25584.50 | -12.50 | (-0.05%) |

| ↓ | DOW FUTURES | USA | 44198.00 | -42.80 | (-0.10%) |

| ↓ | DOW JONES | USA | 44240.77 | -165.60 | (-0.37%) |

| ↑ | NASDAQ | USA | 20418.46 | +5.94 | (+0.03%) |

| ↓ | S&P 500 | USA | 6225.48 | -4.50 | (-0.07%) |

Key Indian Indices

Market Recap – 8th July 2025

| Index | Value | Change | Change (%) | |

|---|---|---|---|---|

| ▼ | INDIAVIX | 12.1950 | -0.3650 | (-2.91%) |

| ▲ | NIFTY50 | 25,522 | 61 | (+0.2%) |

| ▲ | SENSEX | 83,442 | 10 | (+0.0%) |

| ▲ | BANKNIFTY | 57,256 | 307 | (+0.5%) |

NIFTY50 – Pre-Market Analysis (July 9, 2025)

📊 Market Recap (July 9, 2025)

Nifty continued to trade within a narrow band, closing at 25,522.50 with a modest gain of +61.20 points (+0.24%). The index is consolidating near its recent highs, supported well by the 21 EMA. Despite the low volume environment, FIIs continued their buying streak, helping the market hold steady. Broader sentiment remains cautious ahead of macroeconomic data.

📈 Chart Insights

📅 Daily Chart (1D)

- ✅ Price holding above 21 EMA (25,241) – trend still intact

- ✅ Supply near 25,600 – multiple rejections on daily chart

- ✅ Support at 25,350 remains strong

- ✅ Volumes flat – market in pause mode post-rally

🔮 Today’s Outlook (July 10, 2025)

Market bias remains mildly bullish as long as Nifty sustains above 25,350. A decisive breakout above 25,550–25,600 can trigger upside toward 25,750. On the downside, a break below 25,350 may lead to a test of 25,200 support zone.

Expect another session of tight range unless we see directional breakout on strong volume.

🧠 Educational Trade Idea – Bullish Credit Spread (Initiated Last Thursday)

🟢 Sell 25,100 PE

🔴 Buy 25,000 PE

📈 View: Bullish to sideways

💰 Max Profit: If Nifty stays above 25,100 by expiry

⚠️ Exit: If price drops below breakeven (~25,050)

🧘 Risk Profile: Limited risk, fixed reward – suitable for range-bound conditions

📘 This is for educational purposes only. Not a trade recommendation. Please follow SEBI guidelines.

Smart Money Flows

FII (₹ Cr.) & DII (₹ Cr.) Data

| Date | FII (₹ Cr.) | DII (₹ Cr.) |

|---|---|---|

| 08 JUL | -26 | 1,367 |

| 07 JUL | 321 | 1,853 |

| 04 JUL | -760 | -1,029 |

| 03 JUL | -1,481 | 1,333 |

| 02 JUL | -1,562 | 3,037 |

Outro:-

Keep an eye on the key levels and institutional flows—momentum can shift quickly.”