The market took a bearish turn today as Nifty slipped below key support levels, confirming supply pressure near 25,600. With our bearish view still intact and open credit spread position playing out well, the index looks vulnerable to further downside.

In this post, we’ll break down the daily chart setup, key support/resistance levels, and share an update on our current options strategy. Plus, don’t miss our detailed Just Dial stock research report for long-term investors.

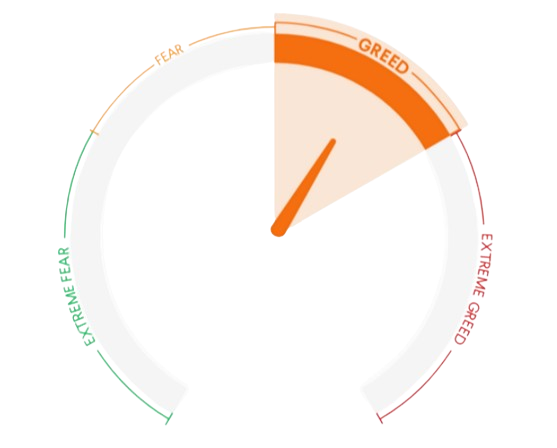

Market Mood Index

60.36

MMI is in the Greed Zone .it suggest that investors are acting greedy in market.

Key Global Indices

Most tracked – As of 07:36 AM, July 11th

| Index/Asset | Country | Value | Change | Change (%) | |

|---|---|---|---|---|---|

| ↓ | GIFTNIFTY | India | 25286.50 | -50.00 | (-0.20%) |

| ↓ | DOW FUTURES | USA | 44466.50 | -184.20 | (-0.41%) |

| ↑ | DOW JONES | USA | 44650.63 | +192.32 | (+0.43%) |

| ↑ | NASDAQ | USA | 20631.36 | +20.03 | (+0.10%) |

| ↑ | S&P 500 | USA | 6280.14 | +16.88 | (+0.27%) |

Key Indian Indices

Indian Market Data

| Index | Value | Change | Change (%) | |

|---|---|---|---|---|

| ↓ | INDIAVIX | 11.6725 | -0.2675 | -2.24% |

| ↓ | SENSEX | 83,190.28 | -345.80 | -0.41% |

| ↓ | NIFTY | 25,355.25 | -120.85 | -0.47% |

| ↓ | BANKNIFTY | 56,956.00 | -257.55 | -0.45% |

NIFTY50 – Pre-Market Analysis (July 11, 2025)

📊 Market Recap (July 11, 2025)

Nifty slipped further, closing at 25,355.25, down -120.85 points (-0.47%). Price action shows clear rejection from the supply zone near 25,600 and a follow-through to the downside.

The index is now testing the 21 EMA support (25,271). Weak volume signals controlled profit booking, but price rejection confirms the short-term bearish sentiment is still active.

📈 Chart Insights

📅 Daily Chart (1D)

- ✅ Price broke below recent support zone at 25,350

- ✅ Trading near 21 EMA (25,271) – a key level to watch

- ✅ Repeated rejection from 25,600 confirms supply pressure

- ✅ Volume slightly higher on red candles – indicating selling interest

- ✅ Next demand zone rests between 24,850–24,750

🔮 Today’s Outlook (July 11, 2025)

The market bias remains bearish unless Nifty reclaims 25,500.

Sustained weakness below 25,250 can drag the index toward the 24,850 zone.

Any bounce toward 25,500–25,550 may face selling pressure unless backed by strong volume.

🧠 Open Options Position – Bearish Credit Spread

🟢 Sell 26,000 CE

🔴 Buy 26,100 CE

📉 View: Bearish

📌 Status: Position Open

✅ So far, view is playing out correctly as Nifty trades well below 26,000.

💰 Max Profit if index stays below 26,000 till expiry

⚠️ Risk Managed: Limited risk with defined reward structure

📘 Also Read: Just Dial Stock Report (2025)

Looking for long-term stock opportunities?

Don’t miss our detailed analysis of Just Dial — fundamentals, growth trends, business outlook, and key levels to watch:

Smart Money Flows

| Date | FII | DII |

|---|---|---|

| 10 JUL | 221 | 591 |

| 09 JUL | 77 | 921 |

| 08 JUL | -26 | 1,367 |

| 07 JUL | 321 | 1,853 |

| 04 JUL | -760 | -1,029 |

📌 Wrapping Up

Nifty continues to consolidate near resistance with signs of weakness creeping in. Our view turns bearish for the short term, and we’ve positioned accordingly with a credit spread strategy.

Stay disciplined, manage risk, and let the levels guide your trades.

📲 Join our community for live updates, trade ideas & analysis:

👉 Click to Join WhatsApp Group