After showing signs of recovery on Tuesday, the Nifty paused just below resistance on Wednesday, signaling a potential consolidation phase. With price hovering under the 21 EMA and volumes staying muted, traders are watching for a decisive breakout.

In today’s analysis, we break down the chart setup, key support/resistance levels, and the ideal trade strategy for the session ahead.

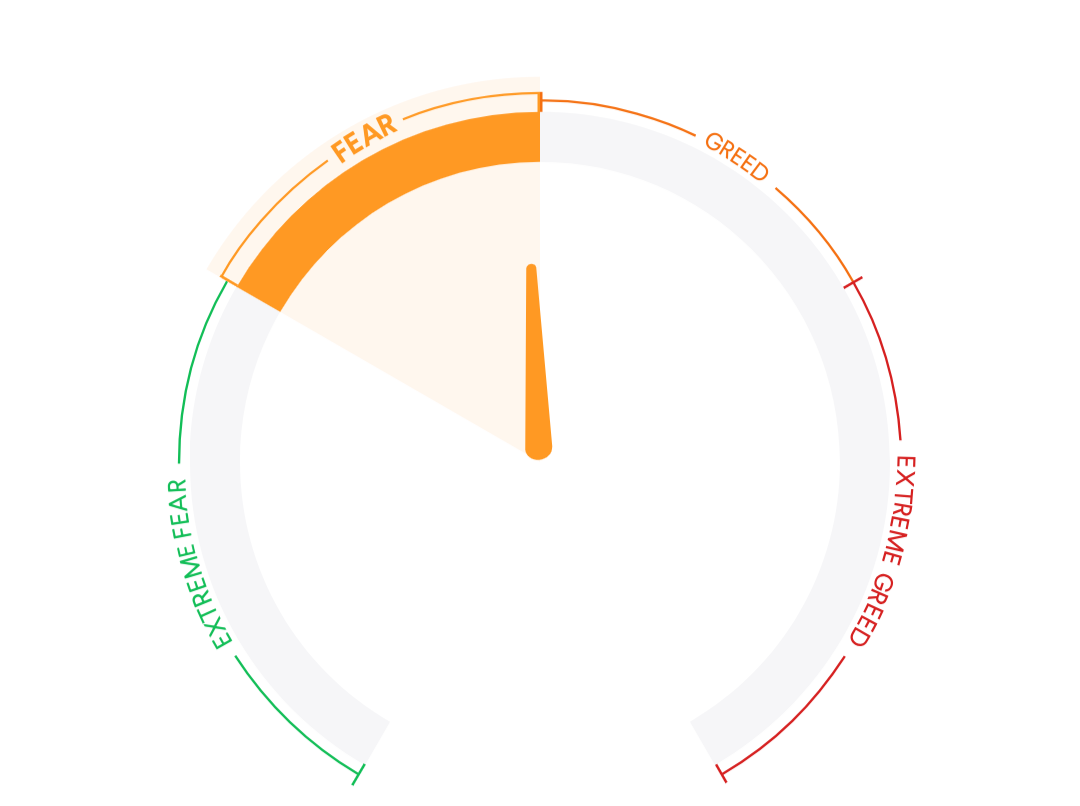

Market Mood Index

43.65

MMI is in the Fear Zone .it suggest that investors are acting Fearful in market.

Key Global Indices

As of 06:58 AM, July 17th

| Index/Asset | Country | Value | Change | Change (%) | |

|---|---|---|---|---|---|

| ↓ | GIFTNIFTY | India | 25272.50 | -9.50 | (-0.04%) |

| ↓ | DOW FUTURES | USA | 44194.20 | -60.60 | (-0.14%) |

| ↑ | DOW JONES | USA | 44254.77 | +231.47 | (+0.53%) |

| ↑ | NASDAQ | USA | 20730.71 | +52.92 | (+0.26%) |

| ↑ | S&P 500 | USA | 6263.58 | +19.82 | (+0.32%) |

Key Indian Indices

Indian Market Data

| Index/Asset | Country | Value | Change | Change (%) | |

|---|---|---|---|---|---|

| ↓ | INDIAVIX | India | 11.2400 | -0.2400 | -2.09% |

| ↑ | SENSEX | India | 82,634.48 | +63.57 | +0.08% |

| ↑ | NIFTY | India | 25,212.05 | +16.25 | +0.06% |

| ↑ | BANKNIFTY | India | 57,168.95 | +162.30 | +0.28% |

NIFTY50 – Pre-Market Analysis (July 17, 2025)

🗓 Nifty Pre-Market Outlook – July 17, 2025

After Tuesday’s bounce, Nifty ended Wednesday on a flat note, closing at 25,212.05 with a mild gain of +16.25 points (+0.06%). The index is now hovering just below the 21 EMA, signaling indecision among bulls and bears.

This pause reflects a classic consolidation phase after a pullback, and today’s session may offer better directional clues. Let’s break it down:

📊 Market Recap (July 16, 2025)

Nifty closed marginally higher after testing intraday lows near 25,100 but managed to hold above key short-term support. The 21 EMA (25,237) is now acting as a ceiling for prices, and the index is struggling to reclaim this dynamic level.

FII flows remained muted and volumes were below average, pointing to cautious participation.

📈 Chart Insights

📅 Daily Chart (1D)

- ✅ Price is holding above 50 EMA (24,923) but still below 21 EMA (25,237)

- ✅ Repeated rejections near 25,240 zone – intraday supply active

- ✅ Support remains near 24,900–25,000 zone

- ✅ Volumes tapering off – market in low conviction zone

- ✅ Overall structure forming a consolidation box between 24,900 and 25,400

🕒 Hourly Chart (1H)

- ✅ Price forming higher lows intraday

- ✅ Short-term buyers active near 25,100

- ✅ No clean breakout above 25,240–25,300 yet

- ✅ RSI holding neutral; no momentum breakout signs

🔮 Today’s Outlook – July 17, 2025

The market remains in a wait-and-watch mode. Nifty needs to decisively close above 25,300 to reignite bullish momentum. Until then, price action will likely remain range-bound.

📌 Key Levels to Watch:

Resistance: 25,240 / 25,300 / 25,400

Support: 25,100 / 24,900

💡 Strategy:

Still waiting to enter. We prefer confirmation above 25,300 for any directional trade.

Until then, we remain on the sidelines and will look for credit spread setups if the range persists.

Smart Money Flows

FII and DII Data (₹ Cr.)

| Date | FII (₹ Cr.) | DII (₹ Cr.) |

|---|---|---|

| 16 JUL | -1,858 | 1,224 |

| 15 JUL | 120 | 1,555 |

| 14 JUL | -1,614 | 1,788 |

| 11 JUL | -5,104 | 3,559 |

| 10 JUL | 221 | 591 |

📌 Wrapping Up

Nifty continues to consolidate near key resistance, and traders should stay cautious unless a breakout or breakdown confirms direction. Price action above 25,300 or below 24,900 will give the next trade trigger.

We’re staying patient and ready with our next move once structure confirms.

Stay disciplined. Trade with logic, not emotion. ✅