Report Date: July 17, 2025

🏢 Company Overview:

Power Finance Corporation (PFC), established in 1986, is a Maharatna public sector enterprise under the Ministry of Power, Government of India. As the largest NBFC in the power sector, PFC is the financial backbone, providing critical funding for power generation, transmission, and distribution projects across India.

PFC’s strategic role extends to supporting key infrastructure reforms and national initiatives, including:

- Renewable Energy Development

- Smart Grid Implementation

- Rural Electrification Programs

- Participation in PM Gati Shakti, Green Energy, and Power for All missions.

PFC is the parent company of REC Limited, consolidating its position as a financial powerhouse in India’s energy financing ecosystem.

📌 Key Financial Highlights

| Metric | Value |

|---|---|

| Market Cap | ₹2 Lakh Cr |

| Earnings Per Share (EPS) | ₹69.67 |

| Price-to-Earnings (P/E) Ratio | 6.08 |

| Dividend Yield | 3.79% |

| Debt-to-Equity (D/E) Ratio | 8.25 |

| Price-to-Book (P/B) Ratio | 1.7 |

| Return on Equity (ROE) | 21% |

| Price/Earnings to Growth (PEG) Ratio | 0.23 |

| Return on Capital Employed (ROCE) | 9.73% |

🔍 Business Model & Value Proposition

PFC’s business model centers around:

- Financial Lending: Providing long-term, secured infrastructure loans to power sector projects.

- Government Backing: As a government-backed entity, PFC benefits from sovereign support and stability.

- Revenue Generation: Primarily through interest spreads earned from its lending activities.

PFC’s value proposition includes:

- Supporting India’s Power Sector: A critical financier for the growth of power infrastructure.

- Contributing to National Goals: Aligning with initiatives like UDAY, Green Energy Corridors, and RDSS.

- Low NPA Risk: Mitigating risks with robust recovery frameworks and refinancing mechanisms.

🚀 Growth Drivers and Future Outlook

PFC is well-positioned to capitalize on several growth drivers:

- Government Initiatives: Benefitting from the government’s focus on infrastructure development and renewable energy expansion.

- Renewable Energy Focus: Supporting India’s transition to a greener energy mix and associated financing needs.

- Stable Demand: Supported by PSU and state entities, providing a reliable customer base.

- Strategic Role: Playing a critical part in key government missions such as PM Gati Shakti, Green Energy, and Power for All.

📊 Technical Analysis

Based on current technical analysis:

Support Levels: ₹406 – ₹410

Resistance Levels: ₹500-₹525

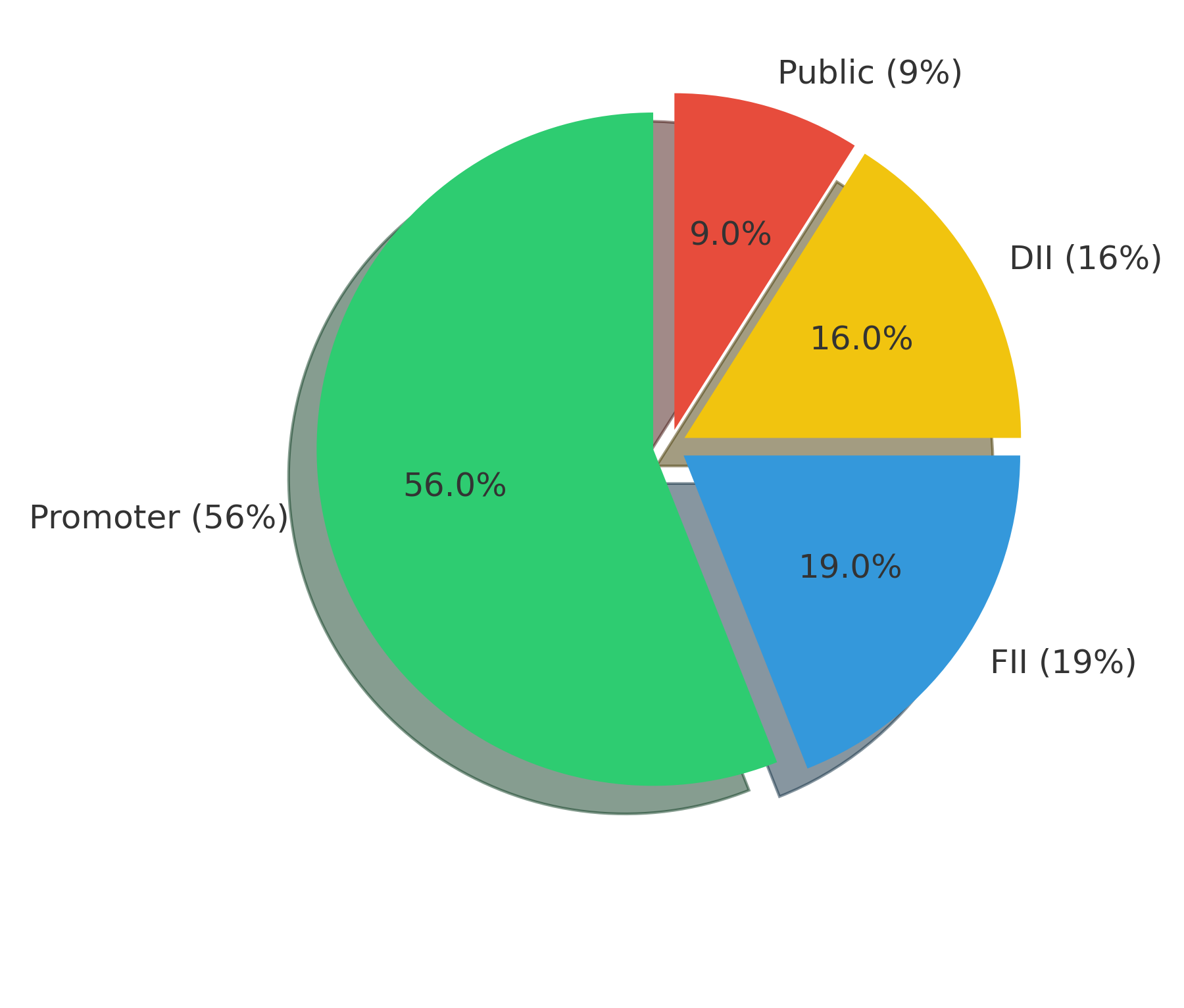

Promoter Holding

Power Finance Corporation – Peer Comparison

| Name | CMP (Rs.) | P/E Ratio | CMP/BV | ROE (%) | Market Cap (Rs. Cr.) |

|---|---|---|---|---|---|

| IRFC | 135.85 | 27.30 | 3.37 | 12.77 | 177535.67 |

| Power Fin. Corpn. (PFC) | 423.55 | 6.14 | 1.17 | 21.01 | 139775.78 |

| REC Ltd | 401.85 | 6.65 | 1.35 | 21.50 | 105816.13 |

| HUDCO | 232.00 | 17.14 | 2.58 | 15.67 | 46444.07 |

| Indian Renewable | 160.10 | 28.80 | 4.24 | 18.05 | 44975.79 |

PFC shows a lower P/E ratio compared to peers like IRFC and Indian Renewable, indicating potentially better value.

💡 Investment Rationale & Recommendation

Key reasons to consider an investment in PFC:

- Consistent Growth: Strong historical performance with impressive 5-year CAGR in Net Profit (26%) and EPS (24%).

- Management Confidence: 0% promoter pledging indicates strong confidence from the management team.

- Attractive Valuation: Favorable P/E ratio compared to the sector median, highlighting the potential undervaluation.

- Government Support: Benefits from a stable business model underpinned by sovereign backing.

- Strategic Role: Key player in India’s critical power and green energy financing plans.

- Operational Efficiency: Demonstrates better net margins and profitability than competitors like REC and IREDA.

- Risk Management: Low NPA levels, indicating a healthy and improving loan book quality.

Disclaimer: This report is for informational purposes only and does not constitute financial advice. Investors should conduct their own research and consult with a qualified financial advisor before making any investment decisions. Market conditions can change, and the past performance of PFC is not indicative of future results.