Report Date: July 24, 2025

🏢 Company Overview:

Cummins India Ltd. is India’s leading manufacturer of diesel and natural‑gas engines and power systems. Founded in 1962 and listed since 1976, it is a subsidiary of U.S.-based Cummins Inc. The company sells across sectors like construction, marine, railways, mining, defense, and agriculture, and exports to over 190 global markets through 200+ branch offices, 21 dealerships, and 3,500+ service touchpoints.

Cummins India plays a strategic role in powering India’s industrial backbone and energy resilience. Its operations directly support key national development initiatives and infrastructure growth, including:

- ✅ Make in India – Localized manufacturing of critical engine and power systems for self-reliance

- ✅ Atmanirbhar Bharat – Reducing import dependency through indigenization of components and technology

- ✅ National Infrastructure Pipeline (NIP) – Supplying backup and distributed power solutions for infra projects

- ✅ Green Mobility & Hydrogen Mission – Investing in zero-emission hydrogen engines, fuel cells & hybrid tech

- ✅ Defense & Strategic Sectors – Trusted supplier for DRDO, Indian Navy, and border infrastructure operations

Cummins India is an integral part of Cummins Inc. USA’s global operations, giving it strong R&D, export capability, and technology access. It is at the forefront of India’s clean energy shift and industrial modernization.

📌 Key Financial Highlights

| Metric | Value |

|---|---|

| Market Cap | Large Cap |

| Earnings Per Share (EPS) | ₹68.59 |

| Price-to-Earnings (P/E) Ratio | 52.68 |

| Dividend Yield | 1.43% |

| Debt-to-Equity (D/E) Ratio | 0.0 |

| Price-to-Book (P/B) Ratio | 14.4 |

| Return on Equity (ROE) | 26% |

| Price/Earnings to Growth (PEG) Ratio | 3.1 |

| Return on Capital Employed (ROCE) | 29% |

🔍 Business Model & Value Proposition

Cummins business model centers around:

- Engine Segment: Produces diesel and gas engines (60 to 4500 HP) for commercial vehicles and industrial machinery.

- Power Systems: Sells generator sets and power generation solutions (7.5 kVA to 3750 kVA).

- Components & Distribution: Offers filtration, turbochargers, emission solutions, fuel systems, and a nationwide service network.

- R&D Edge: Invests in next-gen engine technologies (CPCB IV+, hydrogen, alternative fuels), along with analytics and telematics. Total R&D spend ~₹9.9 Cr (~0.11 % of sales) in FY24.

🚀 Growth Drivers and Future Outlook

- Q2 FY24: revenue up ~15% YoY to ₹1,250 Cr; net profit ₹1800 Cr (↑18%). Export sales grew ~20%..

- Analysts expect 8–10% annual growth, driven by rising genset demand and infrastructure expansion.

- Brokerage views highlight potential upside of ~76%, noting valuation might be near bottom.

📊 Technical Analysis

Based on current technical analysis:

Support Levels: ₹3300 – ₹3350

Resistance Levels: ₹4150-₹4200

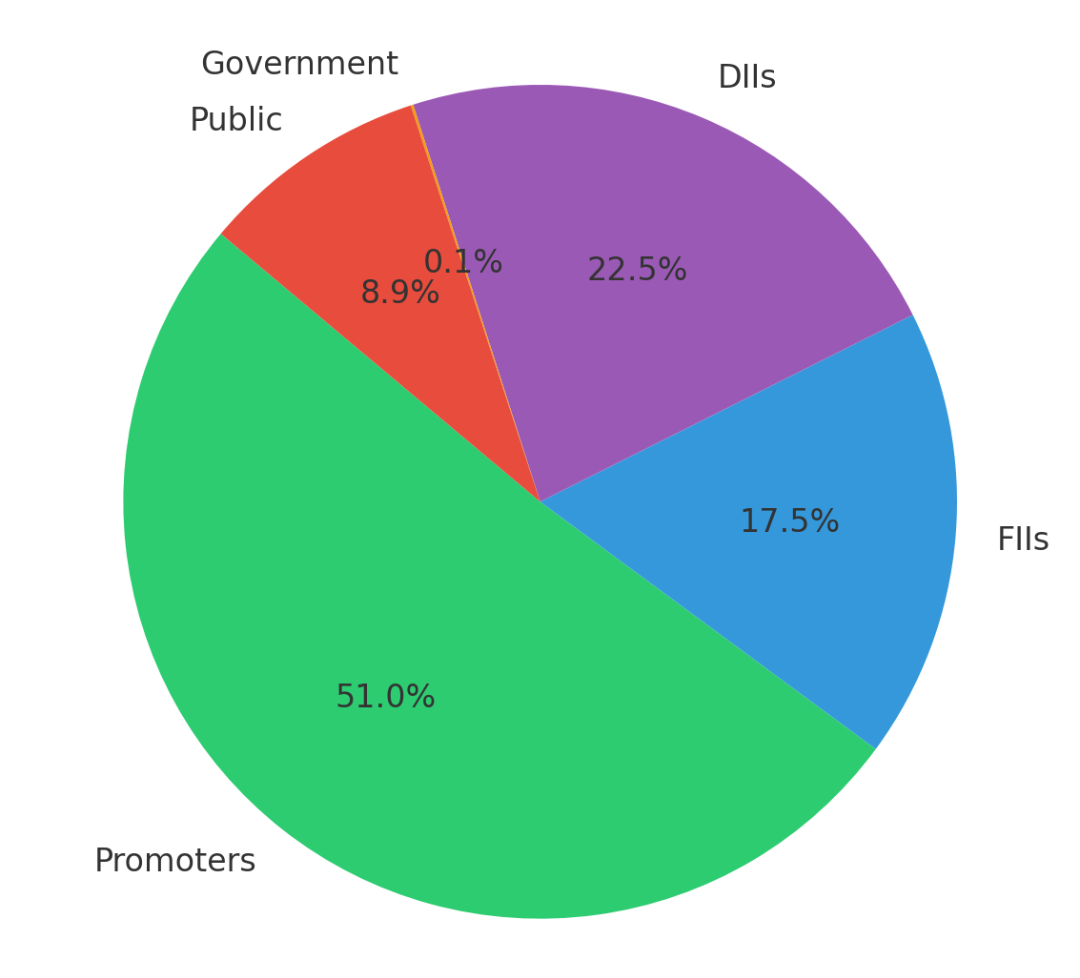

Promoter Holding

Cummins India Ltd – Peer Comparison

| Name | CMP (Rs.) | P/E Ratio | CMP/BV | ROE (%) | Market Cap (Rs. Cr.) |

|---|---|---|---|---|---|

| Elgi Equipment | 597 | 54.28 | 10.14 | 20.06 | 18919 |

| Cummins India Ltd | 3560 | 49 | 13.08 | 28.15 | 98683 |

| KSB | 882.5 | 60.37 | 10.36 | 17.72 | 15359 |

| Shakti Pump | 917 | 27.7 | 9.44 | 42.61 | 11315 |

💡 Investment Rationale & Recommendation

Key reasons to consider an investment in PFC:

- Debt‑free & Liquid Balance Sheet – offers flexibility and downside protection

- High ROE/ROCE reflects operational efficiency and returns

- ⚠️ Premium Valuation P/E & P/B require strong growth execution

- Power Product Demand – continues to rise in infrastructure and backup markets

- ⚠️ Emission/Renewable Trend Risk: transition to green energy may challenge diesel‑focused offerings, though Cummins is developing hybrid/EV technologies

Disclaimer: This report is for informational purposes only and does not constitute financial advice. Investors should conduct their own research and consult with a qualified financial advisor before making any investment decisions. Market conditions can change, and the past performance of PFC is not indicative of future results.