Most DIY investors don’t build portfolios; they create “random collections of funds” based on recent performance or tips. This leads to overlap, hidden risks, and disappointing returns. It’s time to stop guessing and start engineering.

This guide reveals the exact institutional methodology used by top portfolio managers—broken down into a clear, 7-step blueprint that any serious retail investor can implement.

Step 1: The All-Weather Portfolio Blueprint

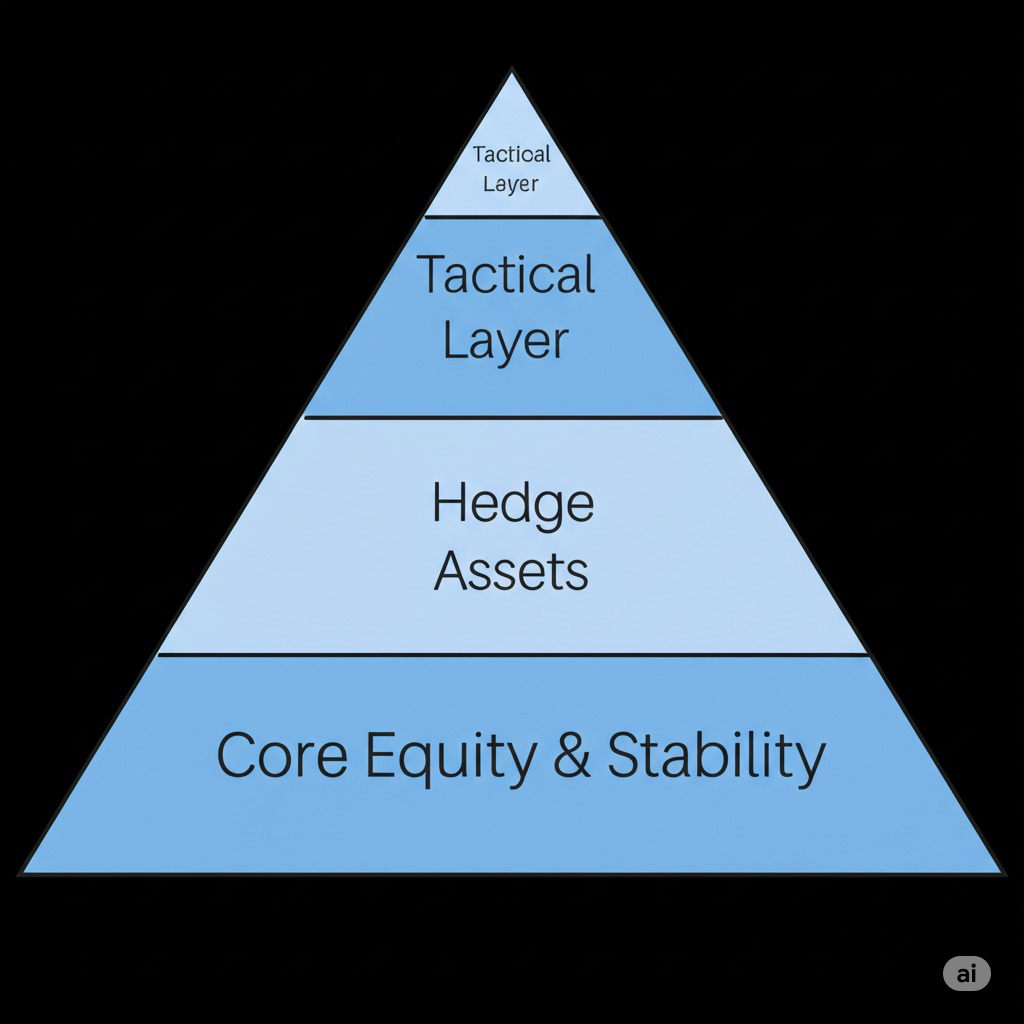

Instead of randomly picking funds, we will structure our portfolio into four distinct layers, each with a specific job. This is a simplified version of the Core-Satellite approach used by large endowments.

The Core Engine (60-70%)

This is the primary growth driver of your portfolio, built with a diversified mix of domestic and global equities. The goal is to capture broad market returns reliably and at a low cost.

| Segment | Instrument Examples | Target Return |

|---|---|---|

| Domestic Large Cap | Nifty 50 ETF (Expense Ratio: ~0.05%) | 12-13% CAGR |

| Domestic Small Cap | High-quality Small Cap Fund | 16-18% CAGR |

| Global Equity | NASDAQ 100 or S&P 500 ETF | 14-15% CAGR |

The Stability Layer (20-30%)

This layer’s job is to reduce volatility and provide capital when equities are down. It is the defensive anchor of your portfolio.

- Core Debt: High-quality Gilt Funds or Target Maturity Funds (3-5 year duration).

- Liquidity: A small allocation to an Overnight or Liquid Fund for emergency cash.

The Hedge Layer (5-10%)

These assets are your insurance policy. They are chosen because they tend to perform well when equities perform poorly, providing crucial portfolio protection.

- Gold: The classic safe-haven asset, held via Gold ETFs (4-6% allocation).

- International Debt: Adds another layer of diversification (2-4% allocation).

The Tactical Layer (0-5%)

This is your “high-conviction” satellite. Use this small allocation for thematic bets like an AI-focused fund or a special situations fund. The rules are strict: never exceed 5% of your total portfolio and have a clear exit strategy (e.g., a 25% stop-loss).

Step 2: Finding the Optimal Mix with the Efficient Frontier

Now that we have our building blocks, how do we combine them? Professionals use a concept called the Efficient Frontier. The goal is to find the specific combination of assets that offers the highest possible expected return for a given level of risk.

While the math is complex, you can use accessible tools to do the heavy lifting:

- Portfolio Visualizer: A powerful free tool for backtesting different asset allocation strategies.

- Value Research: Its portfolio tools can help analyze overlap and performance.

Step 3: Supercharging Returns with Factor Tilts

Factor investing involves “tilting” your portfolio towards specific, proven drivers of long-term returns, such as Quality, Value, and Low Volatility. You can implement this using “Smart Beta” ETFs.

| Factor | ETF Example | Potential Role |

|---|---|---|

| Quality | Nifty100 Quality 30 ETF | For consistent compounding. |

| Low Volatility | Nifty Alpha Low Vol 30 ETF | To reduce portfolio drawdowns. |

| Value | Nifty200 Value 30 ETF | To capture undervalued stocks. |

Step 4: Keeping More Returns with Smart Tax Planning

It’s not just what you earn, but what you keep. Placing the right funds in the right accounts can significantly boost your post-tax returns.

- Taxable Accounts: Ideal for low-turnover instruments like Index Funds and ETFs to minimize capital gains tax.

- Tax-Advantaged Accounts (e.g., ELSS): Best for high-growth, high-turnover funds like active small-cap funds, as the gains are sheltered.

Step 5: Building Your Bulletproof System

The biggest enemy of long-term returns is your own emotional decision-making. A robust system automates good behavior and prevents costly mistakes.

- Automate Your Investing: Set up SIPs with an automatic 10% annual step-up. This enforces discipline.

- Set Rebalancing Triggers: Use tools to automatically rebalance your portfolio back to its target allocation whenever a specific asset class deviates by more than 5%. This forces you to buy low and sell high.

- Minimize Costs: Your portfolio’s expense ratio is one of the best predictors of future returns. Ruthlessly cut costs by preferring ETFs and index funds for your core holdings.

Step 6: The Quarterly Portfolio Review

A professional portfolio is not a “set and forget” instrument. Conduct a disciplined review every quarter, focusing on the system, not the noise.

- Check Asset Allocation: Has any asset class drifted significantly from its target? If so, rebalance.

- Review Performance Drivers: Use attribution tools (like those in Portfolio Visualizer) to understand what drove your returns. Was it your asset allocation, or a specific fund selection?

- Assess Your Funds: Is your active fund manager still sticking to their stated style? Has the expense ratio changed?

Step 7: Putting It All Together (Sample Portfolio)

Here is an example of a well-structured ₹50 Lakh portfolio using this blueprint.

| Layer | Fund Selection | Weight |

|---|---|---|

| Core Domestic | Nifty 50 ETF | 35% |

| Factor Tilt | Nifty Quality 30 ETF | 15% |

| Core Global | S&P 500 ETF | 10% |

| Stability | Gilt Fund (5-Year) | 25% |

| Hedge | Gold ETF | 10% |

| Tactical Satellite | Quant Small Cap Fund | 5% |

This portfolio is designed to have a strong growth engine, a stable defensive layer, and a clear hedge, all while being cost-effective and rules-based.

Final Thoughts: From Random Collection to Optimized Portfolio

Building a winning portfolio is not about chasing the “best” fund of the year. It’s about designing a robust, all-weather system that aligns with your goals and automates disciplined behavior. By following this 7-step blueprint, you can move away from a chaotic collection of funds and build an institutional-grade portfolio engineered for long-term success.

Ready to put this knowledge into action?