The market continues to trade with caution as Nifty hovers near a key demand zone after a string of volatile sessions. With global cues remaining mixed and domestic sentiment fragile, traders are watching support and resistance levels closely for the next directional move.

In today’s post, we break down Nifty’s current price structure, key levels to watch, and our option strategy outlook based on the latest daily chart. If you’re looking for high-probability setups and disciplined trade ideas, read on till the end — and don’t forget to check out our live trade setups shared in our WhatsApp group.

Let’s dive into the full picture 👇

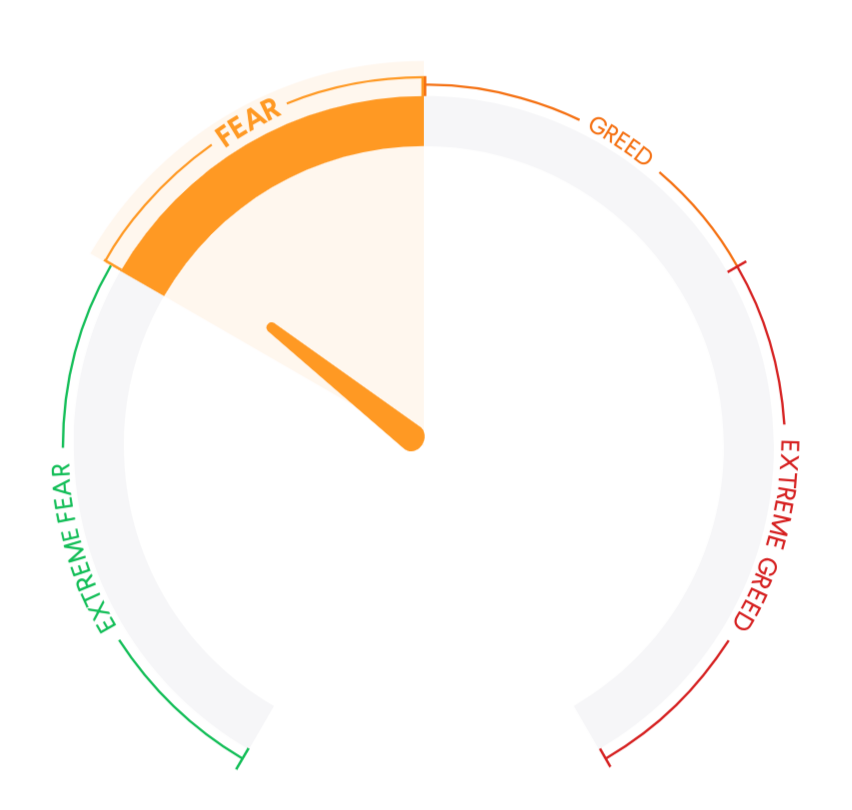

Market Mood Index

32.35

MMI is in the Fear Zone .it suggest that investor are fearful in the market

Key Global Indices

Market Data – August 1st

| Index/Asset | Country | Value | Change | Change (%) | |

|---|---|---|---|---|---|

| ↑ | GIFTNIFTY | India | 24717.50 | +11.00 | (+0.04%) |

| ↓ | DOW FUTURES | USA | 44113.50 | -17.50 | (-0.04%) |

| ↓ | DOW JONES | USA | 44130.99 | -330.30 | (-0.74%) |

| ↑ | NASDAQ | USA | 21138.07 | +8.40 | (+0.04%) |

| ↓ | S&P 500 | USA | 6341.54 | -21.36 | (-0.34%) |

Key Indian Indices

Indian Market Data

| Index/Asset | Value | Change | Change (%) | |

|---|---|---|---|---|

| ↑ | INDIAVIX | 11.5425 | +0.3375 | +3.01% |

| ↓ | SENSEX | 81,185.58 | -296.28 | -0.36% |

| ↓ | NIFTY | 24,768.35 | -86.70 | -0.35% |

| ↓ | BANKNIFTY | 55,961.95 | -188.75 | -0.34% |

NIFTY50 – Pre-Market Analysis (August 1st, 2025)

📉 Nifty Daily Analysis – Friday, August 1, 2025

After a mild bounce on Wednesday, the Nifty once again gave up gains and closed lower by 86.70 points (-0.35%) at 24,768.35 on Wednesday. Despite attempts to recover, the index remains under pressure with lower highs, lower lows, and no convincing reversal yet.

🔍 Chart Highlights:

- A red candle formed below all key EMAs – 21 EMA (orange) and 50 EMA (blue).

- Price failed to reclaim 25,000 resistance, signaling continued weakness.

- Volume remains average, not signaling strong buying interest.

- The downtrend remains intact unless Nifty breaks above 25,000–25,050.

📌 What to Expect Today (Thursday):

- 🔻 Bias: Bearish

- 🟢 Support Zone: 24,600 – 24,650

- 🔴 Resistance Zone: 24,950 – 25,050

- ➡️ No breakout, no reversal yet — stay cautious.

🧠 Strategy Insight – Option Credit Spread

✅ We successfully closed last week’s Bear Call Spread with maximum profit yesterday as Nifty stayed below our short strike.

📅 Today’s Plan (Thursday): We will wait for the first 15–30 minutes after market opens and observe price action near the resistance zone (24,950–25,050). Based on that, we will initiate a fresh credit spread setup

📲 For Live Nifty updates & trade plans,

Smart Money Flows

FII & DII Activity (₹ Cr.)

| Date | FII (₹ Cr.) | DII (₹ Cr.) |

|---|---|---|

| 31 JUL | -5,589 | 6,373 |

| 30 JUL | -850 | 1,829 |

| 29 JUL | -4,637 | 6,147 |

| 28 JUL | -6,082 | 6,765 |

| 25 JUL | -1,980 | 2,139 |

📲 Join our WhatsApp Group for live intraday levels, trade setups, and strategy ideas in real time.

Stay disciplined. Trade with logic, not emotion. ✅