Nifty continued its downward drift on July 15, 2025, closing in the red for the third session in a row. With key levels breaking last week, the index is now approaching a major support zone.

We successfully closed our bearish credit spread strategy with max profit and are currently sitting on the sidelines – waiting for the next high-probability trade setup.

In this post, we decode Nifty’s structure, key support levels, and explain why we’re taking a neutral stance – for now.

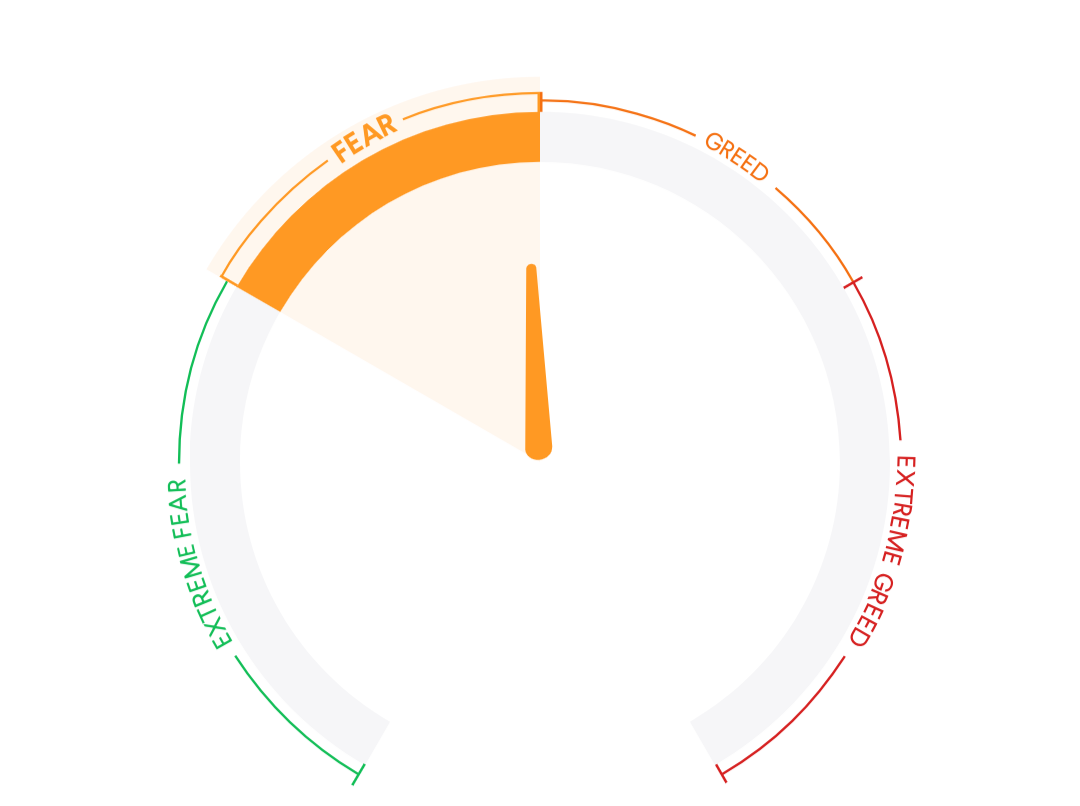

Market Mood Index

49.16

MMI is in the Fear Zone .it suggest that investors are acting Fearful in market.

Key Global Indices

As of 06:50 AM, July 15th

| Index/Asset | Country | Value | Change | Change (%) | |

|---|---|---|---|---|---|

| ↓ | GIFTNIFTY | India | 25153.00 | -21.00 | (-0.08%) |

| ↓ | DOW FUTURES | USA | 44413.50 | -46.20 | (-0.10%) |

| ↑ | DOW JONES | USA | 44459.64 | +88.12 | (+0.20%) |

| ↑ | NASDAQ | USA | 20639.19 | +53.66 | (+0.26%) |

| ↑ | S&P 500 | USA | 6268.11 | +8.36 | (+0.13%) |

Key Indian Indices

| Index/Asset | Value | Change | Change (%) | |

|---|---|---|---|---|

| ↑ | INDIAVIX | 11.9800 | +0.1625 | +1.38% |

| ↓ | SENSEX | 82,253.46 | -247.01 | -0.3% |

| ↓ | NIFTY | 25,082.30 | -67.55 | -0.27% |

| ↑ | BANKNIFTY | 56,765.35 | +10.65 | +0.02% |

NIFTY50 – Pre-Market Analysis (July 15, 2025)

🗓 Nifty Daily Update – July 15, 2025

Another red day for Nifty! 📉

The index slipped further, confirming continued supply pressure. Our bearish credit spread hit maximum profit, and we’ve now closed the position, waiting patiently for the next opportunity.

Here’s the full analysis of the market structure, price zones, and what we’re watching next 👇

📊 Market Recap (July 14, 2025)

Nifty closed at 25,082.30, down 67.55 points (-0.27%), marking the third straight session of weakness. The index continues to drift lower after breaking its 21 EMA and is now approaching the 24,750–25,000 demand zone, where previous buyers had stepped in.

Despite lower volume, price action suggests ongoing profit booking or light distribution.

📈 Chart Insights

📅 Daily Chart (1D)

- ✅ Nifty remains below the 21 EMA (25,244) – confirming short-term weakness

- ✅ Bearish momentum is slowing as price nears previous demand zone (24,750–25,000)

- ✅ Volume remains muted – indicating lack of aggressive selling or buying

- ✅ Market appears to be entering a watch-and-wait phase before decisive move

🧠 Options Strategy Update – Closed Bearish Credit Spread

✅ Trade: Sell 26,000 CE + Buy 26,100 CE

💰 Status: Closed at Max Profit

📌 We booked full gains as Nifty remained comfortably below our breakeven

🧘 Now waiting for a fresh setup to re-enter – will act based on clean structure or breakout/failure

⚠️ As always, educational only. Not financial advice.

Smart Money Flows

| Date | FII (₹ Cr.) | DII (₹ Cr.) |

|---|---|---|

| 14 JUL | -1,614 | 1,788 |

| 11 JUL | -5,104 | 3,559 |

| 10 JUL | 221 | 591 |

| 09 JUL | 77 | 921 |

| 08 JUL | -26 | 1,367 |

📌 Wrapping Up

Markets are cooling off after a strong rally, and Nifty is approaching a key decision zone. Our bearish strategy delivered exactly as expected, and we’ve now exited with full gains.

No new trades at the moment – we prefer to wait for clean setups rather than force entries.Patience is a position too.

📲 Join our community for live updates, trade ideas & analysis: