After two days of minor recovery, the Nifty struggled once again at the 21 EMA and closed lower on Thursday, signaling weakness near the 25,225 zone. The price continues to stay under pressure, forming a lower high and showing rejection at resistance. With macro cues subdued and volumes staying flat, traders should be cautious of another leg down.

Let’s dive into the charts and outline a strategic view for today 👇

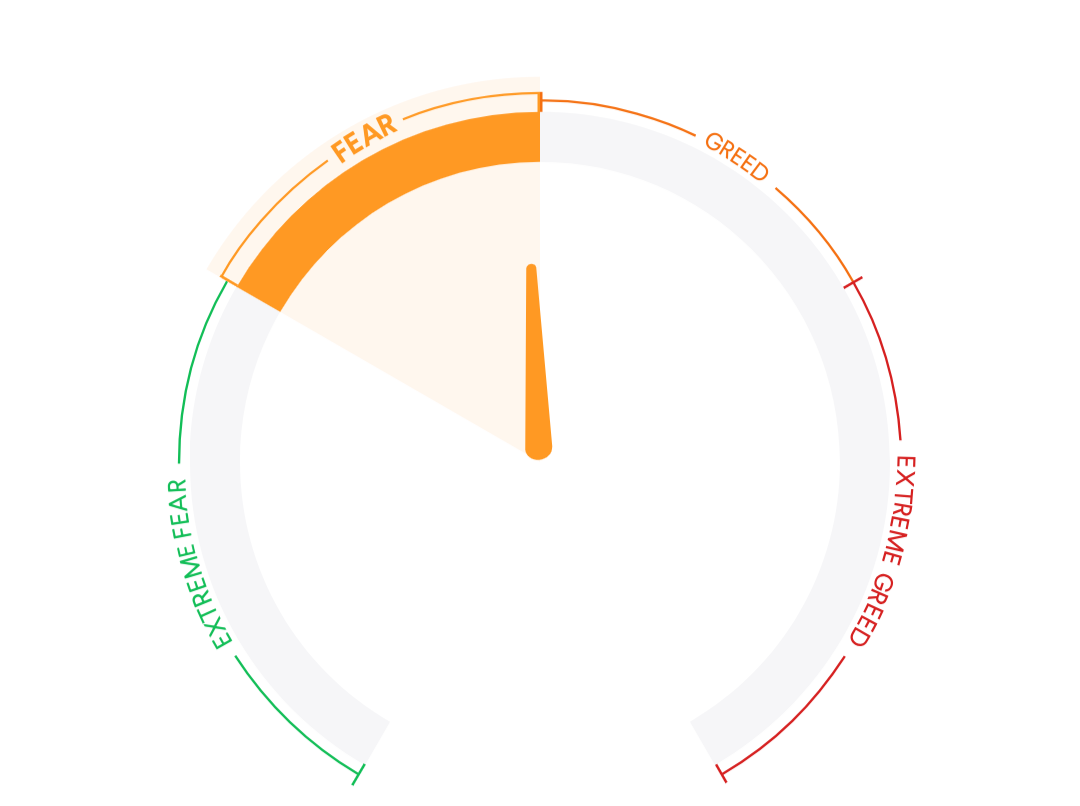

Market Mood Index

44.05

MMI is in the Fear Zone .it suggest that investors are acting Fearful in market.

Key Global Indices

As of 06:50 AM, July 18th

| Index/Asset | Country | Value | Change | Change (%) | |

|---|---|---|---|---|---|

| ↓ | GIFTNIFTY | India | 25201.00 | -12.50 | (-0.05%) |

| ↑ | DOW FUTURES | USA | 44579.00 | +93.90 | (+0.21%) |

| ↑ | DOW JONES | USA | 44484.48 | +229.69 | (+0.52%) |

| ↑ | NASDAQ | USA | 20884.42 | +153.94 | (+0.74%) |

| ↑ | S&P 500 | USA | 6298.49 | +34.79 | (+0.56%) |

Key Indian Indices

Indian Market Data

| Index/Asset | Country | Value | Change | Change (%) | |

|---|---|---|---|---|---|

| ↑ | INDIAVIX | India | 11.2425 | +0.0025 | +0.02% |

| ↓ | SENSEX | India | 82,259.24 | -375.24 | -0.45% |

| ↓ | NIFTY | India | 25,111.45 | -100.60 | -0.4% |

| ↓ | BANKNIFTY | India | 56,828.80 | -340.15 | -0.59% |

NIFTY50 – Pre-Market Analysis (July 18, 2025)

📊 Market Recap (July 17, 2025)

Nifty slipped 100.60 points to close at 25,111.45 (-0.40%), forming a red candle after a brief bounce attempt.

The index is now clearly trading below the 21 EMA (25,225), while the 24,900–25,000 demand zone is being tested repeatedly — a sign of weakening bullish momentum.

Broader sentiment was weak, and FIIs turned net sellers after being neutral for the last few sessions.

📈 Chart Insights

📅 Daily Chart (1D)

- ✅ Price rejected from 21 EMA, showing sellers defending at resistance

- ✅ Nifty remains in a tight range between 24,900 and 25,300

- ✅ Volumes remain muted – no decisive move seen

- ✅ Trendline resistance remains intact; support below 24,900 can trigger further downside

- ✅ EMA structure turning mildly bearish

🔮 Today’s Outlook – July 18, 2025

Nifty is expected to open flat to slightly negative.

Watch for a breakdown below 25,100, which can trigger downside toward 24,900 and then 24,750.

Upside remains capped below 25,225–25,300 unless strong volume-backed breakout occurs.

📌 Bias: Bearish to sideways 📌 Support: 24,900 / 24,750 📌 Resistance: 25,225 / 25,300 🔍 Watch For: Breakdown retest or rejection at EMA zone for directional trades

🧠 Strategy Idea – Bearish Call Spread Setup

💼 View: Bearish to sideways

🟢 Sell 25,500 CE

🔴 Buy 25,100 CE

📈 This spread benefits if Nifty stays below 25,100–25,200 range by expiry

💰 Max Profit: If price closes below 25,100

⚠️ Exit: If Nifty gives closing above 25,300

🧘♂️ Risk Profile: Limited risk, capped reward – ideal for uncertain, sideways-to-down market

📘 For educational purposes only. Always follow SEBI regulations before acting on any strategy.

📌 📘 Bonus Read – Deep-Dive Into Power Finance Corp (PFC):

📊 Want to explore a stock that’s showing long-term potential even in this choppy market?

👉 Read our detailed analysis of PFC here. Includes fundamentals, technicals, and entry strategy for long-term investors.

Smart Money Flows

FII/DII Data (₹ Cr.)

| Date | FII (₹ Cr.) | DII (₹ Cr.) |

|---|---|---|

| 17 JUL | -3,694 | 2,821 |

| 16 JUL | -1,858 | 1,224 |

| 15 JUL | 120 | 1,555 |

| 14 JUL | -1,614 | 1,788 |

| 11 JUL | -5,104 | 3,559 |

📌 Wrapping Up

The Nifty’s price action remains weak below the 21 EMA, with no signs of strong buyer interest yet. A breakdown below 25,100 will likely increase downside pressure. We’re staying cautious with a bearish credit spread setup, waiting for the price to confirm below key levels.

Stay nimble, manage risk, and keep your eyes on quality setups.

📲 Join our WhatsApp Group for Live Trade Ideas & Updates.