After a sharp fall on Friday, bulls made a solid comeback on Monday. Nifty opened Flat and closed with gains of +122 points, reclaiming the 25,000 mark. However, the bigger question is — will this bounce sustain, or is it just a relief rally?

Let’s break down today’s chart setup to understand what lies ahead.

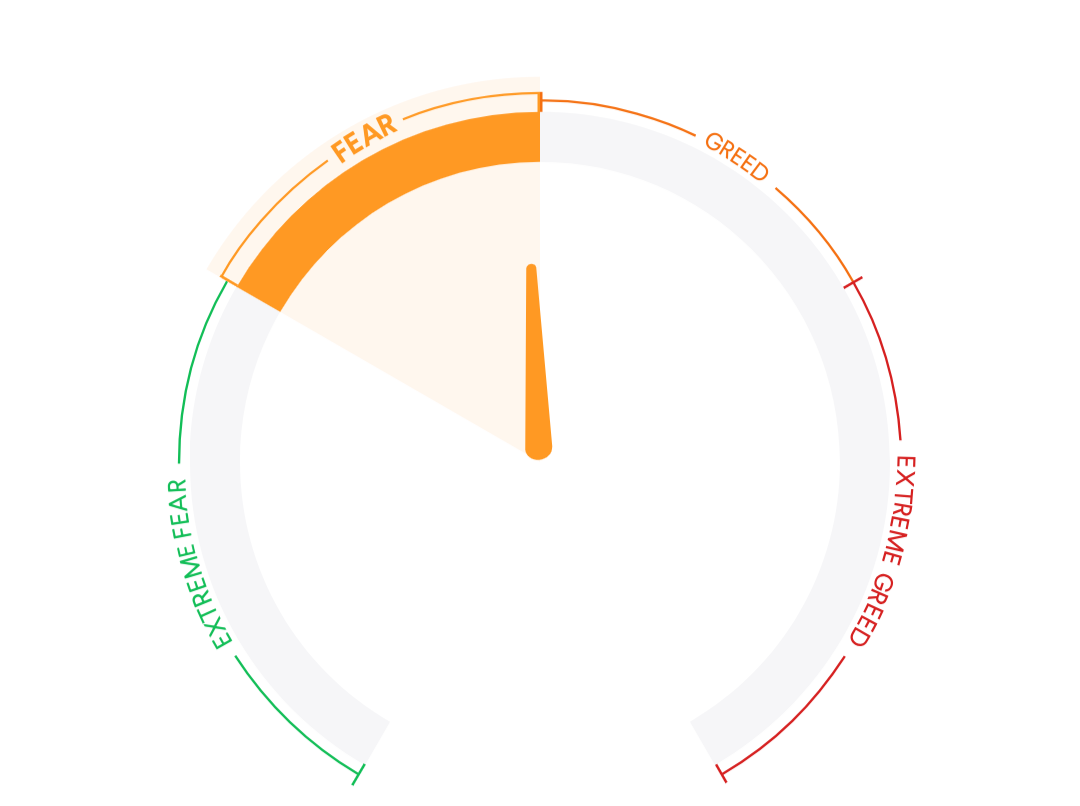

Market Mood Index

39.07

MMI is in the Fear Zone .it suggest that investors are acting Fearful in market.

Key Global Indices

As of 07:19 AM, July 22nd

| Index/Asset | Country | Value | Change | Change (%) | |

|---|---|---|---|---|---|

| ↓ | GIFTNIFTY | India | 25180.50 | -1.50 | (-0.01%) |

| ↑ | DOW FUTURES | USA | 44420.00 | +96.90 | (+0.22%) |

| ↓ | DOW JONES | USA | 44323.06 | -19.14 | (-0.04%) |

| ↑ | NASDAQ | USA | 20975.25 | +79.59 | (+0.38%) |

| ↑ | S&P 500 | USA | 6307.46 | +10.67 | (+0.17%) |

Key Indian Indices

Indian Market Data

| Index/Asset | Country | Value | Change | Change (%) | |

|---|---|---|---|---|---|

| ↓ | INDIAVIX | India | 11.2025 | -0.1900 | -1.67% |

| ↑ | SENSEX | India | 82,200.34 | +442.61 | +0.54% |

| ↑ | NIFTY | India | 25,090.70 | +122.30 | +0.49% |

| ↑ | BANKNIFTY | India | 56,952.75 | +669.75 | +1.19% |

NIFTY50 – Pre-Market Analysis (July 22, 2025)

🧠 Price Action & Technicals

📌 Closing Price: 25,090.70 (+122.30 / +0.49%)

📉 Previous Close: 24,968.40

📊 Candle Type: Strong green candle with decent body – signals bounce attempt

🧭 Support Zone: 24,900 – 24,750

🧱 Resistance Zone: 25,250 – 25,400

📎 50 EMA: Price still hovering near the 50 EMA zone, which is acting as a dynamic support

🔍 Volume: Higher than previous day – adds confidence to the bounce

📌 Key Observations

Nifty took support near the 200 EMA and showed a good intraday reversal.

Volume rose today, indicating participation in the upmove.

Immediate resistance lies around 25,250. A breakout above this could trigger fresh buying.

The market is still inside a short-term correction zone. Bulls need follow-through tomorrow to confirm trend reversal.

🧠 Options Strategy Idea

✅ Sell 25,500 CE

✅ Buy 25,100 CE (to hedge risk)

➤ View: Market likely to stay below 25,100 in the near term

Smart Money Flows

| Date | FII (₹ Cr.) | DII (₹ Cr.) |

|---|---|---|

| 21 JUL | -1,681 | 3,578 |

| 18 JUL | 375 | 2,104 |

| 17 JUL | -3,694 | 2,821 |

| 16 JUL | -1,858 | 1,224 |

| 15 JUL | 120 | 1,555 |

📌 Wrapping Up

The market gave a much-needed breather after Friday’s fall. But the trend is not fully confirmed yet — the next 1–2 sessions are critical. Stay patient and focus only on clean breakout/breakdown setups.

📲 Join our WhatsApp Group for intraday trade ideas, real-time updates, and smart strategies:

Live Market Insights & Trade Ideas

Stay disciplined. Trade with logic, not emotion. ✅