Tuesday’s session opened with a mild gap-up, but the strength didn’t last. Nifty faced strong resistance at the 21 EMA yet again and closed near the day’s low, indicating seller dominance. Price action is slowly shifting bearish, with volumes rising on red candles — a caution sign for bulls. Let’s decode the chart to prepare for today 👇

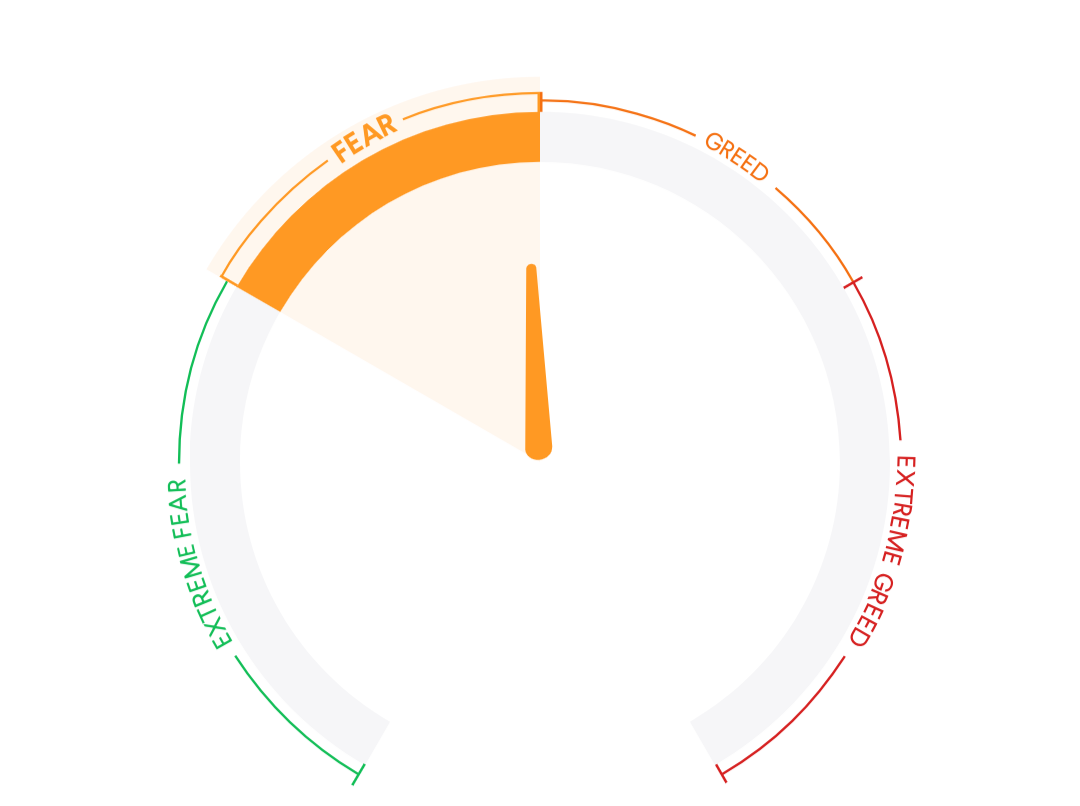

Market Mood Index

42.13

MMI is in the Fear Zone .it suggest that investors are acting Fearful in market.

Key Global Indices

As of 06:52 AM, July 23rd

| Index/Asset | Country | Value | Change | Change (%) | |

|---|---|---|---|---|---|

| ↑ | GIFTNIFTY | India | 25169.50 | +30.50 | (+0.12%) |

| ↑ | DOW FUTURES | USA | 44592.50 | +90.30 | (+0.20%) |

| ↑ | DOW JONES | USA | 44502.45 | +179.37 | (+0.40%) |

| ↓ | NASDAQ | USA | 20895.90 | -78.27 | (-0.37%) |

| ↑ | S&P 500 | USA | 6309.13 | +3.53 | (+0.06%) |

Key Indian Indices

| Index/Asset | Country | Value | Change | Change (%) | |

|---|---|---|---|---|---|

| ↓ | INDIAVIX | India | 10.7525 | -0.4500 | -4.02% |

| ↓ | SENSEX | India | 82,186.81 | -13.53 | -0.02% |

| ↓ | NIFTY | India | 25,060.90 | -29.80 | -0.12% |

| ↓ | BANKNIFTY | India | 56,756.00 | -196.75 | -0.35% |

NIFTY50 – Pre-Market Analysis (July 23, 2025)

📊 Market Recap (July 22, 2025)

📉 Nifty closed at 25,060.90, down 29.80 pts (-0.12%)

📌 Intraday: Gap-up open > rejection at 21 EMA > sharp fall

🔻 Price got pushed back under 25,100, forming a red candle with higher selling volume

🔄 FIIs remained net sellers; broader market sentiment still weak

🔍 Support at 24,943 (50 EMA) held, but is under threat

📈 Chart Insights (Daily – 1D)

- ✅ Repeated rejection at 21 EMA = clear resistance zone

- ✅ Price unable to sustain gap-ups = weak buyer conviction

- ✅ Volume spikes on red candles = distribution signs

- ✅ Immediate support near 24,940–24,900 zone

- ✅ Below 24,900 = risk of deeper correction to 24,750

📉 EMA Setup:

21 EMA (Orange): ~25,180 – acting as resistance

50 EMA (Blue): ~24,943 – immediate support

Price stuck between the two = potential breakout/breakdown

🔮 Today’s Outlook – July 23, 2025

📌 Nifty likely to open flat or slightly negative.

📌 A breakdown below 24,940 may lead to a quick move toward 24,800–24,750.

📌 Upside capped unless price closes above 25,180 with volume.

📉 Bias: Bearish

📌 Support: 24,940 / 24,800

📌 Resistance: 25,180 / 25,300

🔎 Watch For: Breakdown below 24,940 or rejection from 25,100–25,180 for intraday shorts

🧠 Options Strategy Idea:

✅ Sell 25,500 CE

✅ Buy 25,100 CE (to hedge risk)

➤ View: Market likely to stay below 25,100 in the near term

📈 Featured Insight:

Don’t miss our latest stock research report on PFC (Power Finance Corporation) — one of the most promising setups in the current correction phase:

Smart Money Flows

| Date | FII (₹ Cr.) | DII (₹ Cr.) |

|---|---|---|

| 22 JUL | -3,549 | 5,240 |

| 21 JUL | -1,681 | 3,578 |

| 18 JUL | 375 | 2,104 |

| 17 JUL | -3,694 | 2,821 |

| 16 JUL | -1,858 | 1,224 |

📌 Wrapping Up

Nifty’s inability to hold gains and repeated failure at the 21 EMA keeps the pressure on the bulls. Watch the 24,940 support closely — a breakdown could invite another round of selling. Stay cautious and avoid aggressive long trades until strength returns.

📲 Join our WhatsApp Group for live intraday levels, trade setups, and strategy ideas in real time.

Stay disciplined. Trade with logic, not emotion. ✅