Nifty surprised bears with a strong bounce today, reclaiming the 21 EMA and closing well above 25,200. This breakout from a tight range hints at short covering and possibly a short-term bottom around 24,950. While volume isn’t explosive, the price action is constructive for bulls — but resistance overhead still needs to be taken out decisively.

Let’s break it down 👇

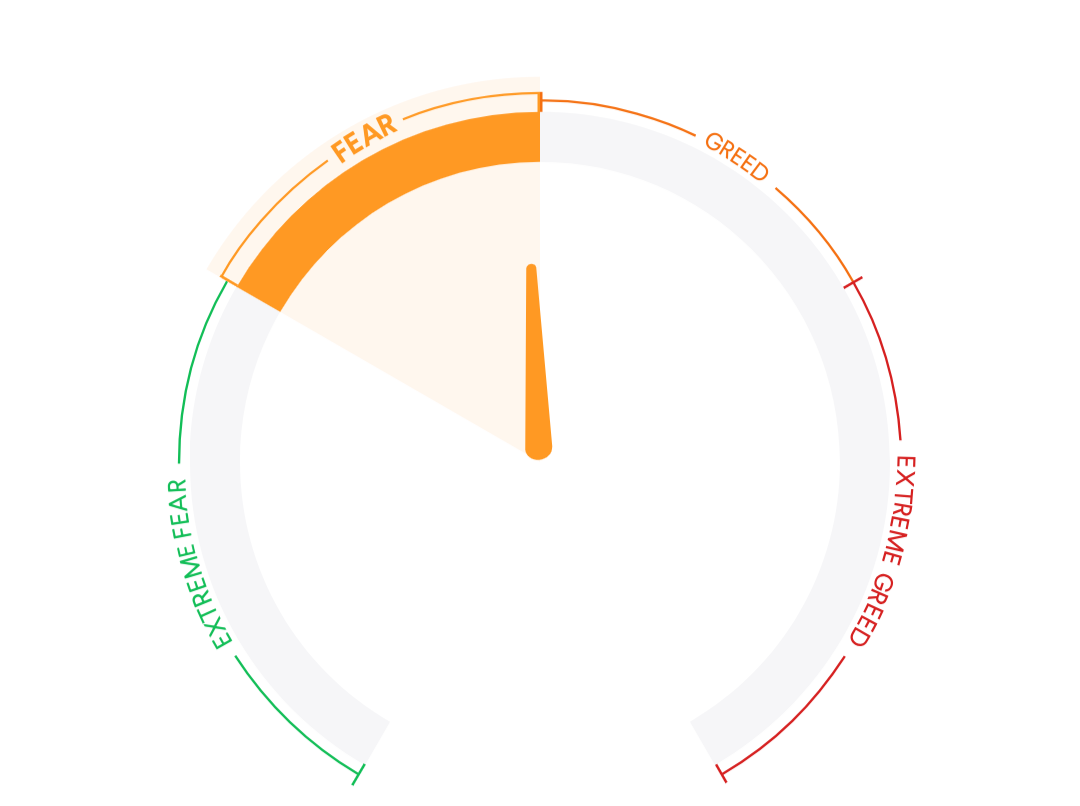

Market Mood Index

47.01

MMI is in the Fear Zone .it suggest that investors are acting Fearful in market.

Key Global Indices

As of 07:20 AM, July 24

| Index/Asset | Country | Value | Change | Change (%) | |

|---|---|---|---|---|---|

| ↑ | GIFTNIFTY | India | 25294.00 | +1.50 | (+0.01%) |

| ↓ | DOW FUTURES | USA | 44906.80 | -103.50 | (-0.23%) |

| ↑ | DOW JONES | USA | 45010.28 | +507.83 | (+1.14%) |

| ↑ | NASDAQ | USA | 21010.32 | +117.64 | (+0.56%) |

| ↑ | S&P 500 | USA | 6359.91 | +50.29 | (+0.80%) |

Key Indian Indices

Indian Market Data

| Index/Asset | Description | Value | Change | Change (%) | |

|---|---|---|---|---|---|

| ↓ | INDIAVIX | India VIX Index | 10.5150 | -0.2375 | -2.21% |

| ↑ | SENSEX | S&P BSE Sensex | 82,726.64 | +539.83 | +0.66% |

| ↑ | NIFTY | Nifty 50 Index | 25,219.90 | +159.00 | +0.63% |

| ↑ | BANKNIFTY | Nifty Bank Index | 57,210.45 | +454.45 | +0.8% |

NIFTY50 – Pre-Market Analysis (July 24, 2025)

📊 Market Recap (July 23, 2025)

✅ Nifty closed at 25,219.90, up +159 pts (+0.63%)

✅ Strong bullish candle formed after 4 days of consolidation

✅ Reclaimed both 21 EMA (25,183) and 50 EMA (24,954)

🔄 Price bounced from key demand zone (24,750–24,900)

📉 Volume still below average but improving

🔁 FIIs neutral to slightly positive; signs of bottom-fishing

📈 Chart Insights – Daily (1D)

- 🟢 Clean bullish candle with close above 21 EMA

- 🟢 Minor volume support — short-covering likely

- 🟢 Strong defense around 24,950 zone for 3rd time

- 🔶 Resistance ahead: 25,350 / 25,500

- 🔻 Support zone: 24,950 / 24,750

📌 Trend Watch: Bullish above 25,200 — may target 25,350–25,500

📌 Risk: If Nifty breaks back below 25,000, downside resumes

🔮 Tomorrow’s Outlook – July 24, 2025

📈 Bias: Bullish to Range-Bound

📌 Support: 25,000 / 24,950

📌 Resistance: 25,350 / 25,500

🔍 Key Level: 25,180 – hold above it for further upside

Expecting a mild gap-up to flat open. Bulls may attempt a follow-through toward 25,350–25,400. But if Nifty slips below 25,100, watch for quick profit booking.

🧠 Option Strategy – Bullish Credit Spread (Limited Risk)

✅ View: Nifty likely to stay above 25,100

🔧 Strategy Type: Bull Put Spread (Credit Strategy)

Trade Setup:

🟢 Sell 25,000 PE

🔴 Buy 24,800 PE

Why?

→ Nifty has reclaimed short-term control and defended 24,950 well

→ Support around 25,000 likely to hold

→ You profit if Nifty closes above 25,000 by expiry

📊 Risk/Reward:

🔐 Max Profit: If Nifty closes above 25,000

❌ Max Loss: If Nifty closes below 24,800

💰 Risk is capped, and reward is limited but high probability

🧘 Ideal for sideways-to-bullish market

📘 For education only. Always manage position sizing and trade within your risk tolerance.

Smart Money Flows

FII & DII Activity (₹ Cr.)

| Date | FII (₹ Cr.) | DII (₹ Cr.) |

|---|---|---|

| 23 JUL | -4,209 | 4,359 |

| 22 JUL | -3,549 | 5,240 |

| 21 JUL | -1,681 | 3,578 |

| 18 JUL | 375 | 2,104 |

| 17 JUL | -3,694 | 2,821 |

📌 Wrapping Up

Nifty has shown signs of recovery with a strong bounce back above EMAs. While there’s overhead resistance, the short-term trend is now mildly bullish. We’re deploying a Bull Put Spread strategy to profit from this bounce — with defined risk and a high probability setup.Stay light, trade safe, and stay updated!

📲 Join our WhatsApp Group for live intraday levels, trade setups, and strategy ideas in real time.

Stay disciplined. Trade with logic, not emotion. ✅