Nifty slipped deeper into the demand zone after repeated rejection near the 25,200 level. Friday’s session saw a sharp sell-off, with price closing near the lower end of the recent range. Volume spiked, and short-term sentiment turned clearly bearish. With 24,750–24,800 now under test, Monday’s session becomes critical for trend validation.

Let’s dive into the full picture 👇

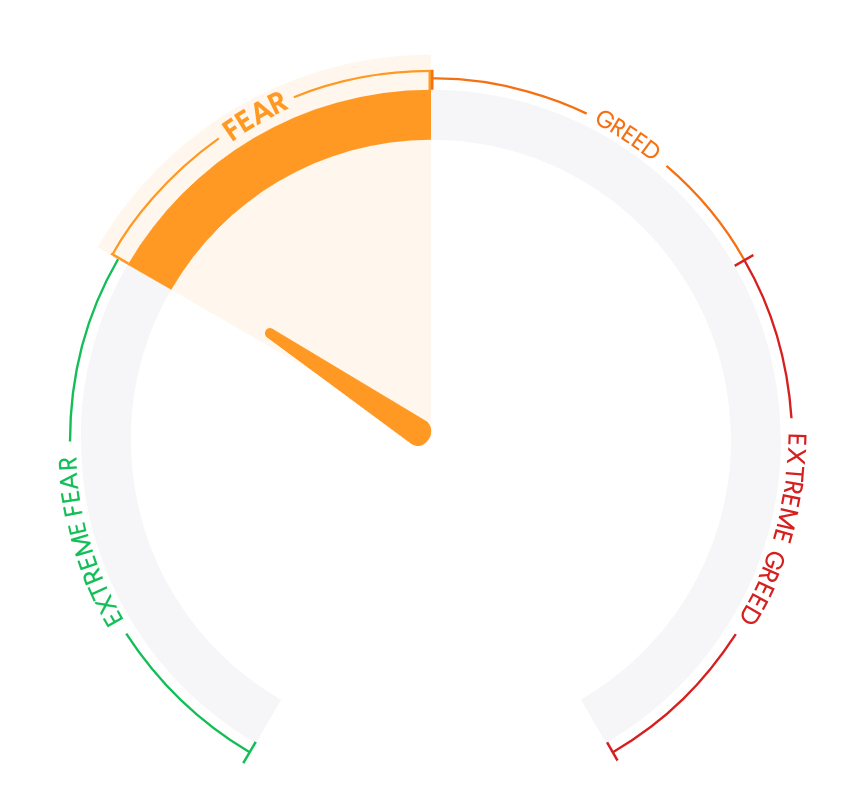

Market Mood Index

31.17

MMI is in the Fear Zone .it suggest that investors are acting Fearful in market.

Key Global Indices

As of 07:55 AM, July 28th

| Index/Asset | Country | Value | Change | Change (%) | |

|---|---|---|---|---|---|

| ↑ | GIFTNIFTY | India | 24837.50 | +22.50 | (+0.09%) |

| ↑ | DOW FUTURES | USA | 45065.50 | +163.60 | (+0.36%) |

| ↑ | DOW JONES | USA | 44901.93 | +208.01 | (+0.47%) |

| ↑ | NASDAQ | USA | 21110.47 | +52.51 | (+0.25%) |

| ↑ | S&P 500 | USA | 6389.59 | +26.24 | (+0.41%) |

Key Indian Indices

Indian Market Data

| Index/Asset | Country | Value | Change | Change (%) | |

|---|---|---|---|---|---|

| ↑ | INDIAVIX | India | 11.2750 | +0.5525 | +5.15% |

| ↓ | SENSEX | India | 81,463.09 | -721.08 | -0.88% |

| ↓ | NIFTY | India | 24,837.00 | -225.10 | -0.9% |

| ↓ | BANKNIFTY | India | 56,528.90 | -537.15 | -0.94% |

NIFTY50 – Pre-Market Analysis (July 28, 2025)

📊 Market Recap (July 26, 2025 – Friday)

🔻 Nifty closed at 24,837.00, down −225.10 pts (−0.90%)

📉 Sharp rejection from 25,150–25,200 again

📉 Closed below 21 EMA and near 50 EMA zone

🔴 High volume on red candle — confirming supply pressure

🔁 FIIs remained net sellers; weak global sentiment also added to the drag

📈 Chart Insights – Daily (1D)

- 🔴 Bearish engulfing follow-through with volume

- 🟠 Price broke below 25,000 psychological level

- 🟢 Testing green zone (24,750–24,850) — previous demand area

- 📉 21 EMA crossed below 50 EMA = short-term trend weakening

- 📉 Volume increasing on down days, hinting strong supply

🔎 Trend Watch

⚠️ Bias: Mildly Bearish to Range-Bound

🔻 Below 24,750 = trend breakdown

📌 Support: 24,750 / 24,600

📌 Resistance: 25,000 / 25,200

🔮 Monday Outlook – July 28, 2025

⚠️ Expect sideways to weak open

📉 Below 24,750 = strong downside possibility

🧠 Bulls must reclaim 25,000+ on closing basis to reset structure

🎯 Watch for early volatility — price likely to test range extremes

🧠 Option Strategy – Bear Call Spread (New Setup)

Since our Bull Put Spread (from July 23) hit breakeven and price failed to hold 25,000, we shifted to a Bearish Spread setup anticipating more downside or at least resistance near 25,000.

📌 Trade Details:

🔴 Sell 25,000 CE

🟢 Buy 25,200 CE

💰 Net Credit: ~₹40–45

📉 Max Profit: If Nifty stays below 25,000

❌ Max Loss: ₹160–₹170 (capped)

⏳ Expiry: Aug 1, 2025

✅ Bias: Mild bearish

🧘♂️ Risk-defined — good R:R if Nifty stays under resistance

🚫 Exit if price closes above 25,050 on hourly basis

Smart Money Flows

| Date | FII (₹ Cr.) | DII (₹ Cr.) |

|---|---|---|

| 25 JUL | -1,980 | 2,139 |

| 24 JUL | -2,134 | 2,617 |

| 23 JUL | -4,209 | 4,359 |

| 22 JUL | -3,549 | 5,240 |

| 21 JUL | -1,681 | 3,578 |

📲 Join our WhatsApp Group for live intraday levels, trade setups, and strategy ideas in real time.

Stay disciplined. Trade with logic, not emotion. ✅