After a weak start to the week, the market continued its downward slide on Monday, showing no signs of reversal. With Nifty now trading below key support levels, traders are on high alert as bearish momentum builds further.

In today’s post, we break down the latest price action, highlight important zones to watch, and update our ongoing strategy from Monday.

Let’s dive into the full picture 👇

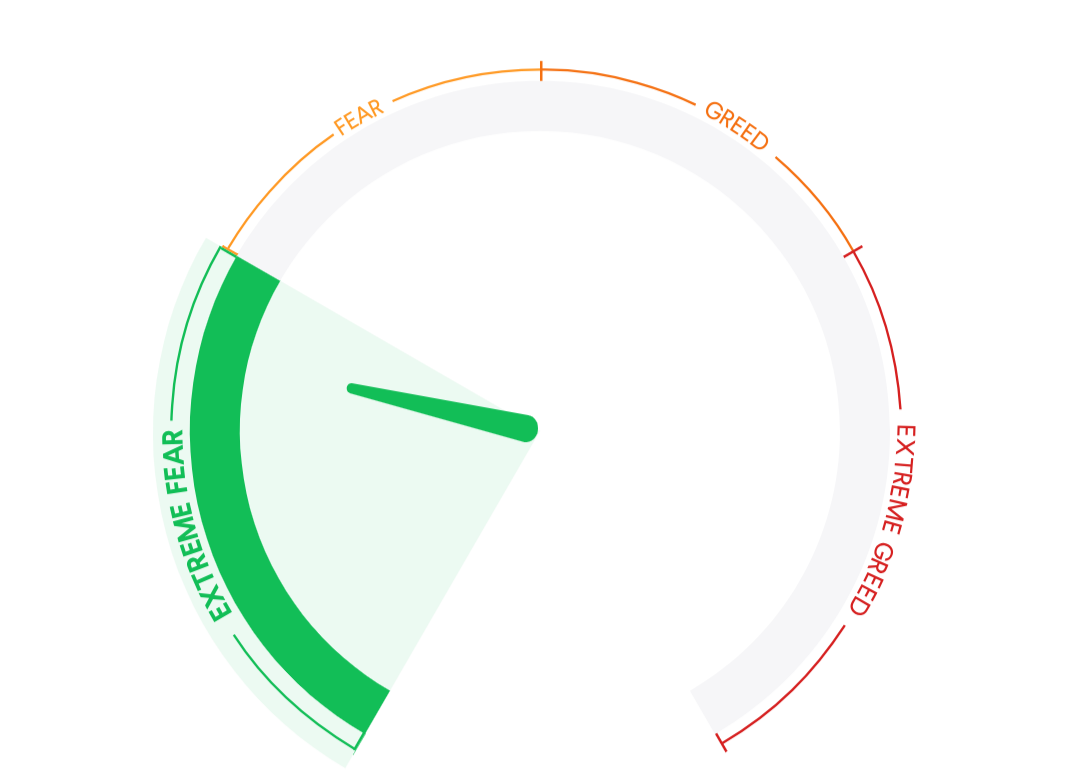

Market Mood Index

24.25

MMI is in the Extreme Fear Zone .it suggest that Markets are likely to oversold and Might turn Upward .

Key Global Indices

As of 07:36 AM, July 29th

| Index/Asset | Country | Value | Change | Change (%) | |

|---|---|---|---|---|---|

| ↑ | GIFTNIFTY | India | 24666.00 | +16.00 | (+0.06%) |

| ↑ | DOW FUTURES | USA | 44862.00 | +24.40 | (+0.05%) |

| ↓ | DOW JONES | USA | 44837.55 | -64.38 | (-0.14%) |

| ↑ | NASDAQ | USA | 21177.78 | +69.47 | (+0.33%) |

| ↑ | S&P 500 | USA | 6389.58 | +0.94 | (+0.01%) |

Key Indian Indices

Indian Market Data

| Index/Asset | Country | Value | Change | Change (%) | |

|---|---|---|---|---|---|

| ↑ | INDIAVIX | India | 12.0625 | +0.7875 | +6.98% |

| ↓ | SENSEX | India | 80,891.02 | -572.07 | -0.7% |

| ↓ | NIFTY | India | 24,680.90 | -156.10 | -0.63% |

| ↓ | BANKNIFTY | India | 56,084.90 | -444.00 | -0.79% |

NIFTY50 – Pre-Market Analysis (July 29, 2025)

📉 Nifty Daily Analysis – Tuesday, July 29, 2025

After last week’s heavy fall, Monday continued the downside, with Nifty closing at 24,680.90, down 156 points (-0.63%). The index has now broken the key support zone of 24,750–24,800, confirming a lower-low formation and deepening bearish structure.

🔍 Chart Highlights:

- Breakdown confirmed below 24,800 demand zone, now a resistance.

- No reversal signs yet – strong bearish candle with solid body.

- Volume rising, showing strong institutional exit or fresh shorts.

- Price trading well below 21 EMA, short-term trend still down.

- No bullish divergence or long wick – bears remain in control.

📌 What to Expect Today (Tuesday):

- 🔻 Bias: Bearish unless key reversal signs emerge.

- 🟢 Support zone: 24,500 – 24,550 (watch for reaction).

- 🔴 Resistance zone: 24,750 – 24,800 (breakdown retest likely).

🧠 Strategy Insight (Carry-Forward):

We are still in the Bearish Credit Spread initiated yesterday.

👉 Stay in the trade until we see an Hourly Close above Break-even level.

No need to exit early – let price action guide the next move.

Avoid fresh longs unless we see a strong bullish reversal candle or hourly trend shift.

📲 Join our WhatsApp group for intraday updates & strategy adjustments:

Join WhatsApp Group

Smart Money Flows

FII & DII Activity (₹ Cr.)

| Date | FII (₹ Cr.) | DII (₹ Cr.) |

|---|---|---|

| 28 JUL | -6,082 | 6,765 |

| 25 JUL | -1,980 | 2,139 |

| 24 JUL | -2,134 | 2,617 |

| 23 JUL | -4,209 | 4,359 |

| 22 JUL | -3,549 | 5,240 |

📲 Join our WhatsApp Group for live intraday levels, trade setups, and strategy ideas in real time.

Stay disciplined. Trade with logic, not emotion. ✅